You've saved for a down payment, found your dream home, and secured a mortgage pre-approval. As a first-time homebuyer, you might think the hard part is over.

Before you cross the threshold of your new home, however, there's one more hurdle to clear: closing costs. These often-overlooked expenses sometimes catch many new buyers off guard. In this post, we'll break down what closing costs are, what they include, and how you can manage them as a first-time buyer.

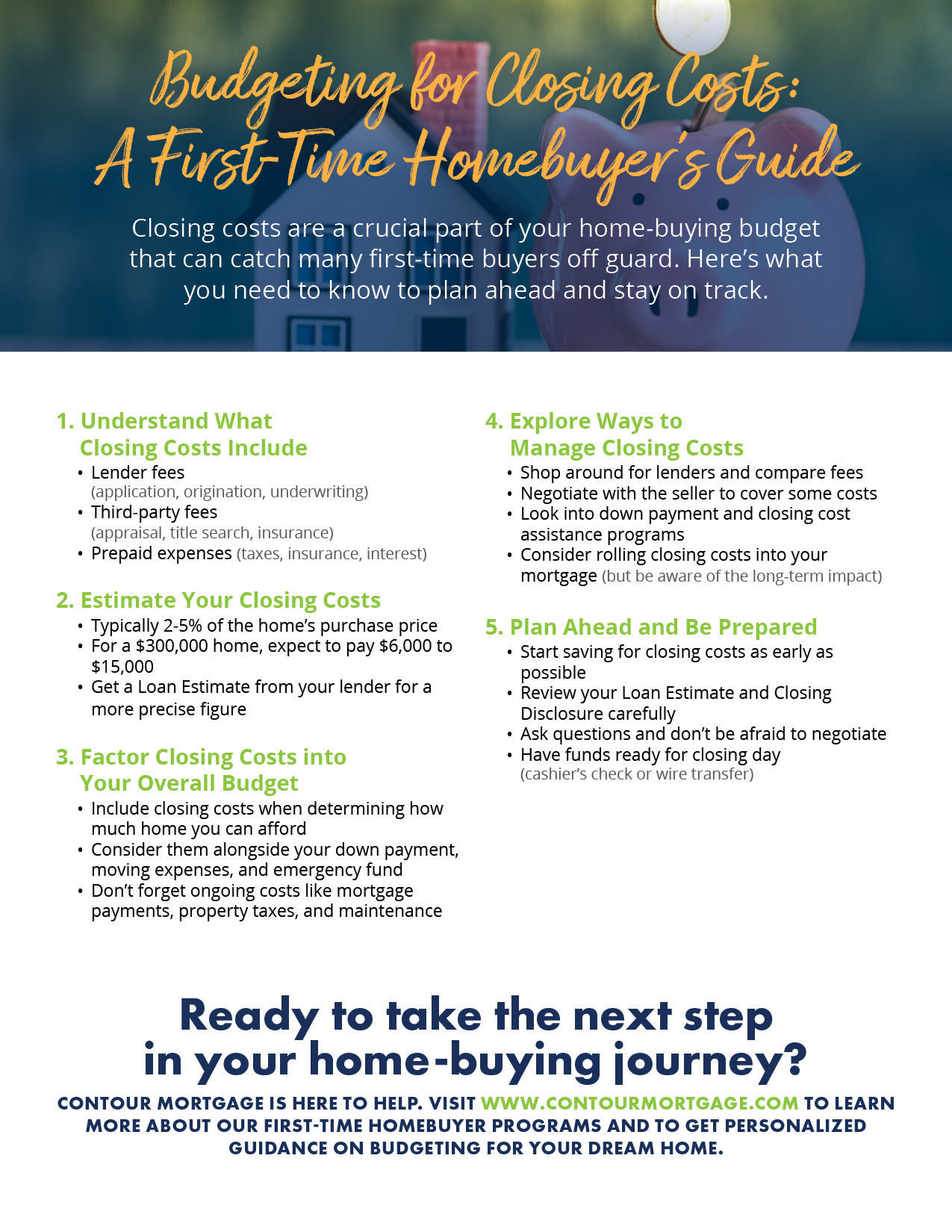

Key Takeaways:

- Closing costs are fees associated with finalizing your mortgage and transferring ownership of the property.

- They typically range from 2% to 5% of the home's purchase price.

- Common closing costs include application fees, appraisal fees, title search and insurance charges, origination fees, and prepaid taxes and insurance.

- Most of the time, buyers are responsible for paying closing costs, but sellers may sometimes agree to contribute.

- There are several strategies first-time buyers may consider to manage and reduce closing costs.

What Are Closing Costs?

Closing costs are fees associated with finalizing your mortgage and transferring ownership of the property. They are separate from your down payment and typically due when you sign your final loan documents at closing. These costs cover a wide range of services, from home appraisals and title searches to mortgage origination and legal fees. Failing to plan for closing costs is one of the common mistakes first-time homebuyers make.

On average, closing costs range from 2% to 5% of the home's purchase price. So, if you're buying a $300,000 home, you could expect to pay between $6,000 and $15,000 in closing costs. However, the exact amount will depend on a variety of factors, including your location, lender, and the type of loan you choose.

Our local experts will guide you through the home loan financing process and set you on the path toward homeownership. Apply for pre-approval from Contour Mortgage.

What's Included in Closing Costs?

Closing costs encompass a variety of fees and expenses, some of which are non-negotiable (such as government-mandated taxes), while others may be negotiable (lender fees, for example). Here are several common closing costs you might encounter:

- 1) Application Fee: Charged by the lender to process your mortgage application, this fee covers the cost of credit checks, document preparation, and other administrative tasks.

- 2) Appraisal Fee: Paying for a professional appraisal of the home's value, lenders require this to ensure the home is worth the amount they're lending.

- 3) Attorney Fees: If your state requires an attorney to handle real estate transactions, their fees will be included in your closing costs.

- 4) Title Search & Title Insurance: A title search ensures there are no liens, disputes, or other issues with the property's ownership. Title insurance protects you and the lender from any problems that may arise from the title after closing.

- 5) Origination Fee: This covers the lender's administrative costs for processing your loan, and is often a percentage of the total loan amount.

- 6) Prepaid Property Taxes & Homeowners Insurance: Many lenders require you to pay a certain amount of property taxes and the first year's homeowners insurance premium at closing.

- 7) Discount Points: An optional fee paid to the lender at closing to secure a lower interest rate on your mortgage, each point typically costs 1% of the loan amount and reduces your rate by 0.25%.

- 8) Recording Fees: These are charged by your local government to officially record the change in property ownership.

Other potential costs include flood certification, survey fees, and mortgage insurance (if your down payment is less than 20%).

Your lender is required to provide you with a Loan Estimate within three business days of receiving your application. This document will detail all expected closing costs. Three business days before closing, you'll receive a Closing Disclosure, which finalizes those costs. Review these documents carefully and ask questions if anything is unclear.

Who Pays Closing Costs?

In most cases, the buyer is responsible for the majority of closing costs. However, it's not uncommon for buyers and sellers to negotiate who pays certain fees. For example, a seller eager to close the deal might offer to cover a portion of the closing costs as an incentive. This is known as a seller concession.

Some closing costs, such as the real estate agent's commission, are typically paid by the seller. However, in a competitive market, a buyer might offer to cover these costs to make their offer more attractive.

Tips for Managing Closing Costs as a First-Time Buyer

- 1) Shop Around for Lenders: Don't just go with the first lender you find. Compare offers from multiple lenders, paying attention to their closing costs. Some may offer lower fees or special programs for first-time buyers.

- 2) Negotiate Where Possible: Some fees, such as the application or origination fee, may be negotiable. Don't be afraid to ask your lender if they’re willing to reduce or waive certain costs.

- 3) Consider Asking the Seller to Contribute: Especially if they're motivated to sell quickly, the seller may be willing to cover some of your closing costs. This would be negotiated as part of your offer.

- 4) Look Into Down Payment & Closing Cost Assistance Programs: Many states, counties, and cities provide programs to help first-time buyers with down payments and closing costs. These may come in the form of grants, low-interest loans, or tax credits.

- 5) Budget Early: Factor estimated closing costs into your overall home-buying budget from the start. This will help you avoid surprises and ensure you're looking at homes in your price range.

- 6) Consider Rolling Closing Costs Into Your Mortgage: Some lenders allow you to include closing costs in your loan amount. While this can reduce your upfront expenses, it will increase your monthly payments and the total cost of your loan over time.

Remember, while closing costs feel like an extra hurdle, they're a normal part of the home-buying process. By understanding what they are and planning for them early, you can navigate this final step to homeownership with confidence.

Your Trusted Partner in Homeownership

At Contour Mortgage, we understand that buying your first home is overwhelming. That's why our experienced team is here to guide you every step of the way, from pre-approval to closing day. We'll work with you to find the right loan for your unique situation and help you understand all the costs involved.

Ready to take the next step in your home-buying journey? Contact us today to learn more about our first-time homebuyer programs, competitive rates, and exceptional customer service. Let us help you turn your dream of homeownership into a reality.