Buying your first home is an exciting journey that opens the door to new possibilities. While the process may seem complex at first, being aware of common pitfalls will help you navigate the path to homeownership with confidence.

Here are 12 mistakes to avoid to improve your odds of embarking on a successful and rewarding home-buying experience:

1. Not Working With Local Experts

One of the best ways to ensure a smooth home-buying process is to partner with local experts. Experienced real estate agents and mortgage lenders provide invaluable guidance, helping you find the perfect property within your budget and navigate the intricacies of financing. Embrace the opportunity to collaborate with these professionals and leverage their expertise to make your homeownership dreams a reality.

2. Failing to Get Pre-Approved Early

Many buyers start house hunting without getting pre-approved for a mortgage. House-hunting is incredibly exciting, and it’s easy to fall in love with a property you later learn is beyond your price range. Obtaining pre-approval as early as possible gives you a clear understanding of your budget and makes you a more attractive buyer to sellers.

PRE-APPROVAL TIPS

-

Gather Your Documents

Collect recent pay stubs, W-2s, tax returns, bank statements, and details of your assets and debts.

-

Check Your Credit

Review your credit report, dispute any errors, and avoid opening new credit lines.

-

Shop Multiple Lenders

Compare offers from a few lenders to find the best rates and terms for your situation. A local expert could help provide you with important insights into the market, making it easier to navigate the process.

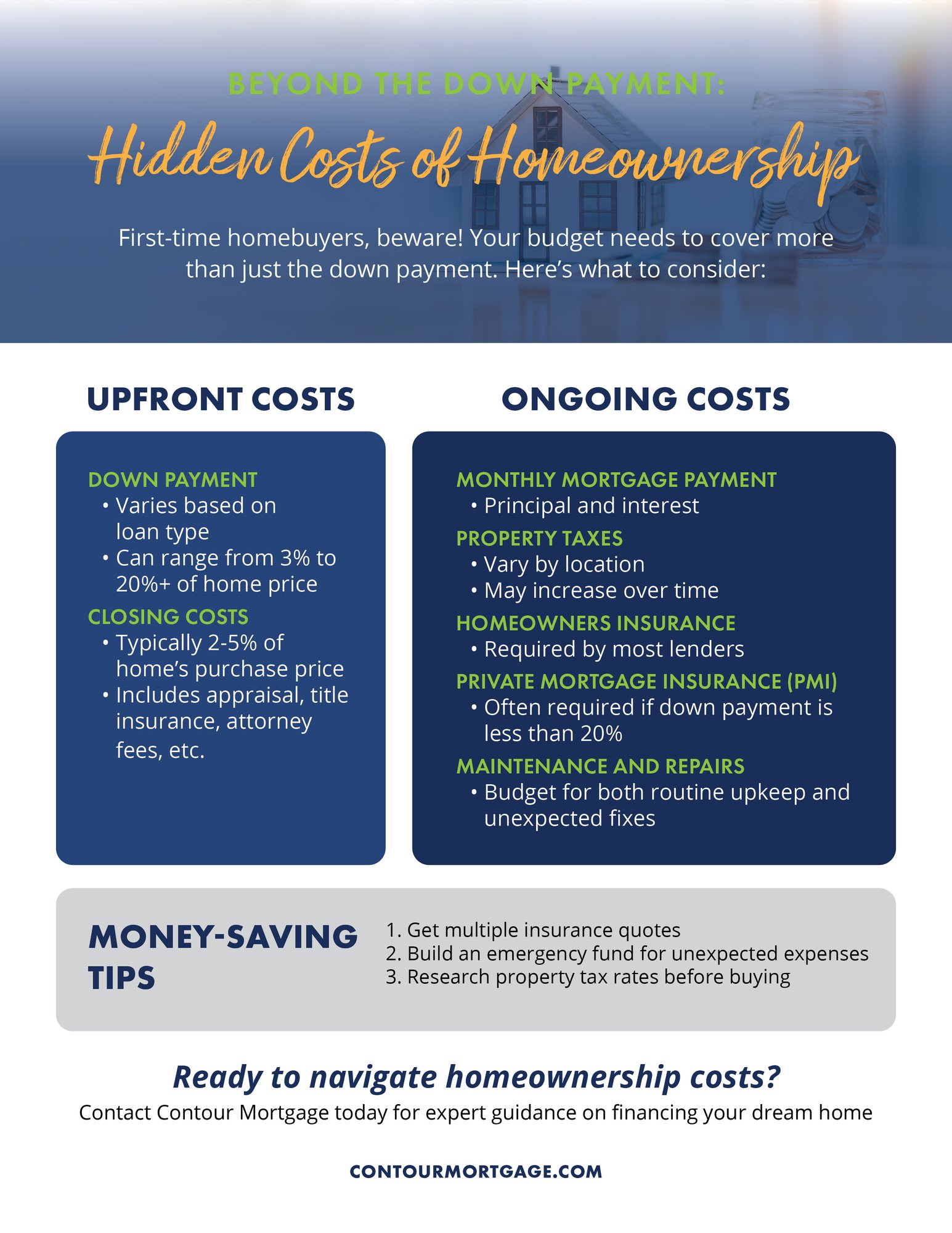

3. Underestimating the Total Costs of Homeownership

The purchase price of a home is just the beginning. It’s understandable to forget about other associated costs such as property taxes, homeowners insurance, utilities, and ongoing maintenance. A comprehensive understanding of all home-related expenses makes the transition from home-seeker to homeowner that much easier. Researching potential state-level tax rebates also helps paint a clearer picture of your spending.

4. Neglecting to Check & Improve Credit Scores

Your credit score plays a vital role in determining your mortgage eligibility and interest rates. Be sure to check your credit score well in advance of applying for a mortgage to avoid unpleasant surprises. Take the time to review your credit report, correct any errors, and work on improving your score if necessary.

5. Not Saving Enough for Closing Costs

Attaining an iron-clad estimate regarding your closing costs isn’t always easy. That’s largely because fees vary, and no two home purchases are the same. However, it’s important to have a basic idea of how much you’ll owe on the day you're given the keys to your new house.

Closing costs can amount to 2-5% of its purchase price, and include expenses such as appraisal fees, title insurance, and attorney fees. You’ll want to budget wisely so you’re fully prepared when it’s time to sign on the dotted line.

6. Skipping the Home Inspection

In a competitive market, some buyers may be tempted to waive the home inspection to make their offer more attractive. This is a risky move that might lead to costly surprises down the road. Always insist on a professional home inspection to uncover any potential issues with the property.

7. Changing Financial Circumstances During the Process

Making major purchases or changing jobs during the home-buying process may jeopardize your mortgage approval. Lenders will re-check your financial information before closing, and any significant changes could delay or even derail your home purchase.

Here are some major purchases to avoid while attempting to secure your mortgage:

- Buying a Car: Taking on a new car loan significantly impacts your debt-to-income ratio, which is a key factor in mortgage approval. Even if you're not financing the car, the large expenditure might raise red flags.

- Purchasing Expensive Appliances or Furniture: While tempting to start shopping for your new home, making large purchases on credit cards or through financing is not recommended.

- Booking Lavish Vacations: Charging expensive trips or experiences affects your credit and depletes savings you'll need for closing costs and other home-buying expenses.

- Cosigning Loans for Others: Cosigning a loan for a family member or friend makes you legally responsible for that debt. This additional liability impacts your debt-to-income ratio and make lenders reluctant to approve your mortgage.

8. Not Researching the Neighborhood

When you find a house that feels like home, it's easy to get swept up in the excitement. However, it's crucial to look beyond the property itself and consider the surrounding neighborhood. After all, you're not just buying a house—you're becoming part of a community. Take the time to research the area, including school districts, future development plans, and proximity to amenities that matter to you.

9. Overlooking First-Time Homebuyer Programs

Many first-time buyers are unaware of the various assistance programs available—and that’s okay! Now would be a good time to conduct some due diligence. These programs include down payment assistance, tax credits, or special loan programs. Research local and national programs that could make homeownership more affordable for you.

10. Rushing the Process

While it's natural to feel excited and eager to find your dream home, taking your time will lead to a more successful and satisfying home-buying experience.

Here are some benefits of embracing a patient approach:

- Finding the Right Fit: By taking your time to explore different properties and neighborhoods, you increase your chances of finding a home that truly aligns with your needs, lifestyle, and long-term goals. Don't settle for a house that doesn't feel right just because you're in a rush.

- Making Informed Decisions: Moving quickly through the home-buying process leads to overlooking important details or making impulsive choices. Carefully considering each aspect of the purchase—from property inspections to loan terms—will help you make a more informed decision you'll feel confident about in the long run.

- Negotiating Better Terms: When you're not in a hurry to close the deal, you have more leverage in negotiations. Take the time to work with your real estate agent to craft competitive offers and negotiate favorable terms, such as repairs, closing costs, or contingencies.

- Avoiding Buyer's Remorse: Rushing into a home purchase results in regrets down the line. By taking a patient, thoughtful approach, you minimize the risk of buyer's remorse and will feel secure in your decision for years to come.

11. Ignoring the Importance of Location

When searching for your perfect home, it's easy to focus solely on the property itself. However, location plays a crucial role in shaping your daily life and long-term satisfaction. Consider factors such as convenience, commuting options, growth potential, and natural beauty when choosing your dream neighborhood.

Prioritizing location in your home search will help you find a property that not only meets your needs but enhances your lifestyle. Work with your real estate agent to identify locations that align with your preferences and offer the best potential for your investment.

With careful consideration, you'll be one step closer to unlocking the door to your ideal home and community.

12. Not Considering Different Mortgage Options

With so much to consider, many first-time buyers forget to explore all their lending options. There are various types of mortgages available, each with its own advantages and considerations:

- Conventional Loans

- FHA Loans

- VA Loans (for Veterans & Active Military)

- USDA Loans (for Rural Areas)

- Adjustable-Rate Mortgages (ARMs)

- Fixed-Rate Mortgages

Each of these options has different requirements for down payments, credit scores, and debt-to-income ratios. Some may also offer benefits such as lower interest rates or reduced mortgage insurance. Taking the time to understand these options and choose the one that best fits your financial situation will save you thousands of dollars over the life of your loan.

The Importance of Expert Guidance

There’s nothing quite like navigating the home-buying process—especially for first-time homebuyers. Waking up in a house that is truly yours for the first time is one of those experiences you’ll never forget.

Working with experienced professionals helps make the journey feel a bit easier and more personal. While a knowledgeable real estate agent will provide valuable market insights, help you find properties that meet your criteria, and guide you through negotiations, a reputable local mortgage lender helps you understand your financing options, get pre-approved, and ensure a smooth closing process.

Being aware of these potential pitfalls and seeking expert guidance enables you to approach your first home purchase with confidence, and increases your chances of a successful and satisfying experience.

Ready to fully embrace your home-buying journey? Contact Contour Mortgage today to speak with our experienced team of local mortgage experts. We're here to guide you through the process, help you avoid common mistakes, and find the perfect financing solution for your first home purchase.