Here's a surprising fact that could impact your financial future: According to a Zillow survey, 72% of prospective homebuyers choose not to shop around for their mortgage. That's a significant majority of buyers who might be missing out on better rates, terms, or services by settling for the first lender they find.

Why Your Choice of Mortgage Lender Matters

Your mortgage lender isn't just a means to an end—they're your financial partner in what may be the largest purchase of your life.

The right match can mean:

- Potentially better rates and terms that could save you thousands of dollars throughout the life of your loan

- A smoother, more transparent process

- Access to loan programs that best fit your unique situation

- Expert guidance through complex decisions

- Local market insights that can prove invaluable

Understanding Your Options: Types of Mortgage Lenders

Before diving into how to choose a lender, it's important to understand the different types available:

Traditional Banks

These are the financial institutions you're likely most familiar with. They often offer mortgages, alongside other banking services.

Potential Benefits:

- Convenient if you already have a banking relationship

- May offer relationship discounts

- Generally stable and well-regulated

Considerations:

- Might have stricter qualification requirements

- May take longer to process loans

- Limited flexibility in loan programs

Local Mortgage Companies

These lenders, such as Contour Mortgage, specialize in home loans and often have deep knowledge of local markets.

Potential Benefits:

- Specialized mortgage expertise

- Local market knowledge

- Often more flexible lending criteria

- Personalized service

- Usually faster processing times

Considerations:

- May not offer other banking services

- Important to verify credentials and reputation

Online Lenders

A growing segment of the mortgage market, these lenders operate primarily through digital platforms.

Potential Benefits:

- Often feature streamlined digital processes

- May have lower overhead costs

- Typically offer quick initial pre-approvals

Considerations:

- Limited personal interaction

- May not understand local market nuances

- Could be challenging to reach a specific person if issues arise

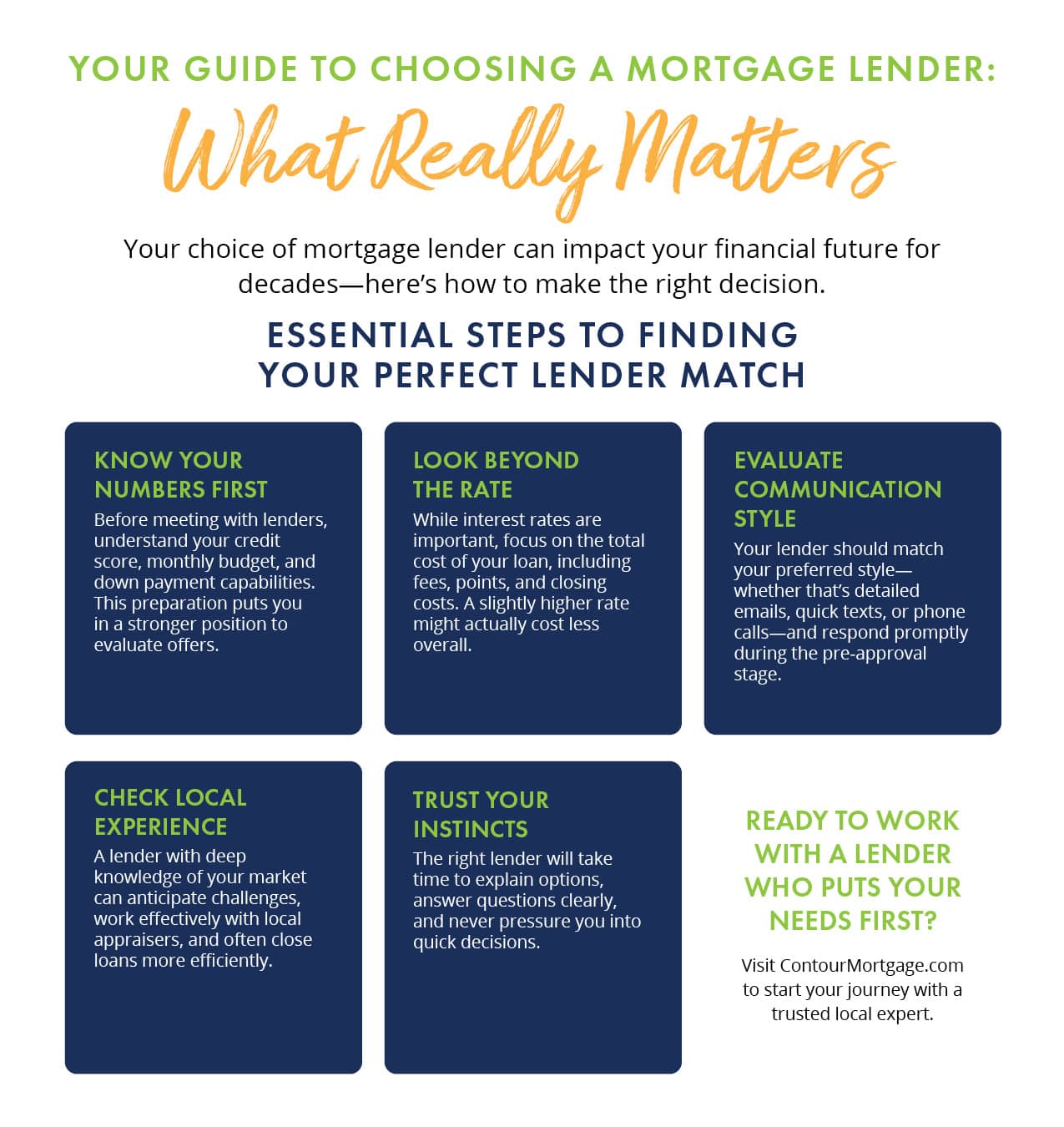

Essential Qualities to Look for in a Mortgage Lender

Zillow's research reveals that about a quarter of buyers stick with the first lender they contact, often due to satisfaction with initial interactions. While finding a good match right away is possible, here's what you should evaluate to ensure you're making an informed choice.

Experience & Expertise

Look for a lender who demonstrates:

- Deep understanding of various loan programs

- Track record of successful closings

- Knowledge of local market conditions

- Ability to explain complex terms clearly

- Experience with situations similar to yours

Transparent Communication

According to the survey, 14% of buyers hesitate to shop around due to concerns about sharing financial information.

A trustworthy lender should:

- Clearly explain what information they need and why

- Outline their privacy protection measures

- Provide detailed breakdowns of fees and costs

- Offer regular updates throughout the process

- Be responsive to your questions and concerns

- Set realistic expectations about timeline and requirements

Program Variety & Flexibility

Your ideal lender should offer:

- A range of conventional loan options

- Access to government-backed programs

- Specialty programs for unique situations

- Competitive rates and terms

- Flexible down payment options where possible

Making Your Selection: A Step-by-Step Approach

Step 1: Initial Research (Addressing Time Concerns)

It’s common for buyers to avoid shopping around because they believe it takes too much time and effort. Here's an efficient approach.

Start with a list of three to four lenders, including:

-

- A local specialist

- Your current bank

- A recommended lender from a trusted source

Prepare your basic information, once:

-

- Employment history

- Income details

- Basic asset information

- Desired loan amount

Step 2: The Initial Conversation

Despite the perception that lenders generally offer similar rates, significant variations exist in both rates and terms.

During your initial conversation, ask:

- What loan programs might fit your situation

- Current rate ranges for those programs

- Estimated closing costs

- Timeline expectations

- Documentation requirements

- Communication process preferences

Step 3: Understanding the Full Cost Picture

When comparing lenders, look beyond the basic interest rate to understand:

Loan Costs

- Origination fees

- Points (if applicable)

- Processing fees

- Underwriting fees

- Other lender charges

Third-Party Costs

- Appraisal fees

- Title insurance

- Recording fees

- Credit report fees

Pro Tip: Request a Loan Estimate from each lender you're seriously considering. This standardized form makes it easier to compare offers side by side.

Addressing Credit Score Concerns

Perhaps the most significant finding from Zillow's survey is that 30% of buyers avoid shopping around due to concerns about their credit score.

Here's what you should know:

- Multiple mortgage inquiries within a 14- to 45-day period typically count as just one inquiry for credit scoring purposes.

- Shopping around may actually help you find a lender with programs better suited to your credit profile.

- Some lenders consider factors beyond just credit scores when evaluating applications.

Red Flags to Watch For

When evaluating potential mortgage lenders, trust your instincts and be alert to warning signs that could signal potential issues. A reputable lender will never pressure you into making quick decisions about such a significant financial commitment, nor should they be reluctant to provide written estimates or clear explanations of their fees.

Consider it a warning sign if you're having difficulty getting timely responses to your questions during initial conversations—this often indicates how communications might flow throughout the entire loan process.

Above all, be wary of any promises that seem too good to be true or significantly different from what other lenders have offered. The best lenders prioritize transparency and understand that building trust is essential for a successful partnership.

The Contour Mortgage Difference

With more than 30 years of experience serving homebuyers, we understand what matters most to our clients, including the following:

- Local Market Expertise: Our deep understanding of your real estate market helps ensure smooth transactions.

- Diverse Loan Programs: We offer a wide range of conventional and government-backed options to suit various needs.

- Personal Service: Work with a dedicated loan officer who knows your story, from application to closing.

- Strong Local Network: Benefit from our established relationships with local real estate professionals.

- Proven Track Record: Join thousands of successful homebuyers who've trusted us with their mortgages.

Taking the Next Step

Choosing the right mortgage lender is a crucial decision in your home-buying journey. While the process may seem daunting, taking time to find the right match can lead to both immediate and long-term benefits.

Ready to explore your mortgage options? Our experienced loan officers are here to discuss your unique situation and help you understand the programs available to you. Contact Contour Mortgage today for a no-obligation consultation, and take the first step toward finding your perfect mortgage match.